Edd Employee Withholding 2024 – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . The Department of General Services’ Telework Tracker estimated that CalEPA, CalHHS and EDD employees together saved more 20 million commute miles and avoided 7,384 metric tons of carbon dioxide .

Edd Employee Withholding 2024

Source : edd.ca.gov📢 Employers! Effective January 1, 2024, Senate Bill 951 will

Source : www.instagram.comEDD on X: “Employers, here are two things you should do when you

Source : twitter.com4 Employee Withholding 2022 2024 Form Fill Out and Sign

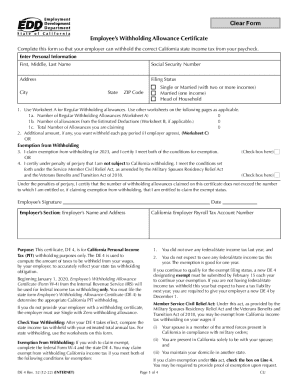

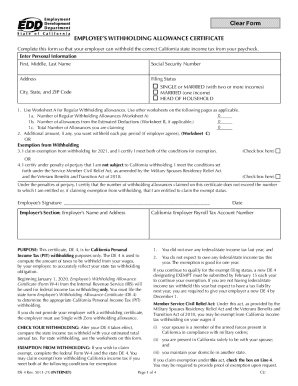

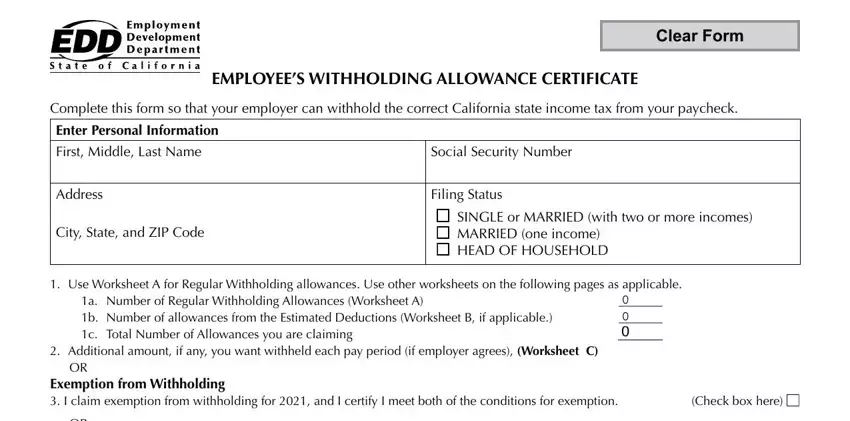

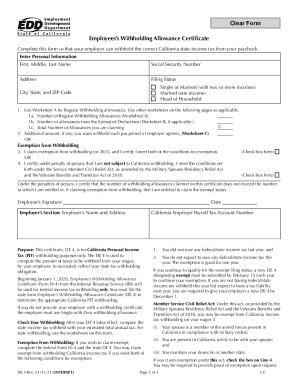

Source : www.signnow.comCA DE 4 2021 2024 Fill and Sign Printable Template Online

Source : www.uslegalforms.comCalifornia Form De 4 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comCA EDD DE 4P 2018 2024 Fill and Sign Printable Template Online

Source : www.uslegalforms.comDe4 2021 2024 Form Fill Out and Sign Printable PDF Template

Source : www.signnow.com2024 Changes to Employee Payroll Taxes : r/Redding

Source : www.reddit.comYear in Review: Danger Signs Aplenty for California’s Economy in

Source : gvwire.comEdd Employee Withholding 2024 Employee’s Withholding Allowance Certificate (DE 4) Rev. 53 (12 23): Jeff is a writer, founder, and small business expert that focuses on educating founders on the ins and outs of running their business. From answering your legal questions to providing the right . Payroll taxes are withheld from each employee’s paycheck to fund Social Security and Medicare. Employers are responsible for withholding their employees’ taxes and submitting them, along with .

]]>